The November 2024 issue of Smart Business Pittsburgh Magazine features an article from Blue River’s Partner, Sara Clevenger.

/ Smart Business Pittsburgh / An organization is only as good as its people. At no time is that truer than during an M&A integration.

Integrating the workforces of two companies can be complex. Undermanaging this critical piece can lead to losing key employees, decreased morale and decline in productivity. On the other hand, a well-executed talent management strategy can foster a smooth transition, retain top talent and create a unified, energetic workforce.

In the case of two organizations of similar size coming together in an approximate merger of equals, both the acquirer and the target company must be deliberate about retaining key talent. While leadership teams tend to protect their own people and corporate cultures, key focus should be on keeping the people best suited to drive the combined company’s performance. Accordingly, a fair and transparent selection process is needed to avoid (real or perceived) biases or favoritism on the part of either legacy company.

When a larger, often better-performing company acquires a smaller or lower-performing firm that operates within its core business, employee selection tends to favor the acquirer’s incumbent talent. In such cases, the acquirer’s retention focus may be narrower, aimed at the best performers or employees deemed critical for maintaining business continuity.

In an acquisition involving the entry into a new business or market, the buyer’s talent retention focus will likely be quite different. Typically, retaining the target firm’s employees is essential to the deal’s value, and there is usually limited overlap between the target’s workforce and that of the acquiring company, aside from support functions.

Here are some of the hallmarks of an intentional, systematic Talent Management process which can support successful outcomes no matter the complexion of the deal.

Early Planning: Talent management should be a priority from the early stages of the M&A process. Conducting thorough due diligence on the target company’s workforce, culture and HR practices can help identify potential challenges and opportunities.

Cultural Integration: One of the biggest challenges in any deal is blending different corporate cultures. Employees from the acquired company often feel uncertain about their future, leading to resistance and disengagement. Addressing cultural differences and fostering a sense of belonging is crucial.

Retention Programs: Implement retention programs to incentivize key talent to stay. This can include financial incentives, career development opportunities and clear communication about their future roles and growth prospects within the combined entity.

Transparent Communication: Maintain open lines of communication with employees at all levels. Regular updates and Q&A sessions can help address concerns, dispel rumors and build trust.

Leadership Alignment: Ensure that the leadership teams from both companies are on the same page. Joint leadership workshops, strategy sessions and team-building activities can help strengthen a collective, powerhouse team.

At the end of the day, any two organizations coming together must tackle two core challenges around talent: how to retain people critical to the combined company’s performance and how to manage the employee selection in a way that causes the least disruption and anxiety. Intentional preparation and management of both are critical to driving the economic outcomes for which the deal objective originated. Ultimately, the success of any transaction hinges not just on financial metrics but on the people who drive the business forward.

Original content is available on the Smart Business website here as well as in the digital issue of the November 2024 Smart Business Pittsburgh Magazine.

Sara Clevenger, Partner, leads and scales the buy-side practice while providing leadership and direction to Blue River’s integrated services model. Ms. Clevenger brings over 15 years of experience in Corporate Development, Mergers & Acquisitions, Commercial Real Estate Development, Portfolio and Transaction Management. Sara’s full bio is available here.

About Blue River

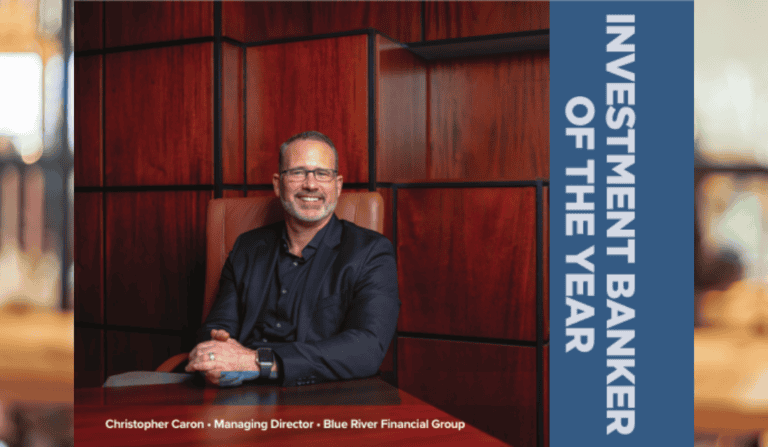

Blue River Financial Group is a middle market merger and acquisition advisory firm. We assist corporations, private equity groups and individuals in the sale and acquisition of businesses and have completed assignments in multiple business segments. With over 20 years of experience spanning across 50 global industries, Blue River provides a suite of services to middle market clients including corporate development, private equity support, valuations, and transaction consulting, placing a premium on relationship-centered transaction counsel and client focus.