The North American Mergers and Acquisitions (M&A) market has been experiencing mixed performance through the first nine months of 2024, reflecting uncertainty across the economy but also highlighting pockets of opportunity for strategic deal-making. In this article, we explore the current state of M&A, with a focus on the middle market, hot industries, and emerging trends driving deal activity.

Overview of M&A Market Performance

The North American M&A market has cooled off in the wake of 2021’s record year but appears to be stabilizing and starting to improve. Through the third quarter of 2024, the total transaction volume has reached $920 billion, with over 8,000 deals executed. That’s within a hair of the full-year 2023 results of $1 trillion of transaction volume on 11,000 deals.

While these figures demonstrate a robust market, they also point to a slight slowdown from previous years, largely driven by economic uncertainties and evolving industry dynamics. The market is still far away from 2021’s record of $2.2 trillion of North American M&A volume across 16,000 deals.

Industry-Specific Trends

Certain sectors continue to see strong M&A activity, driven by the continued push for efficiencies through economies of scale, technological advancements, and shifts in consumer behavior. Leading the charge in deal count are the industrials, information technology, financials, and consumer discretionary sectors.

On the other hand, sectors like real estate and utilities are seeing fewer deals, indicating more selective activity.

M&A Activity in the U.S. Middle Market

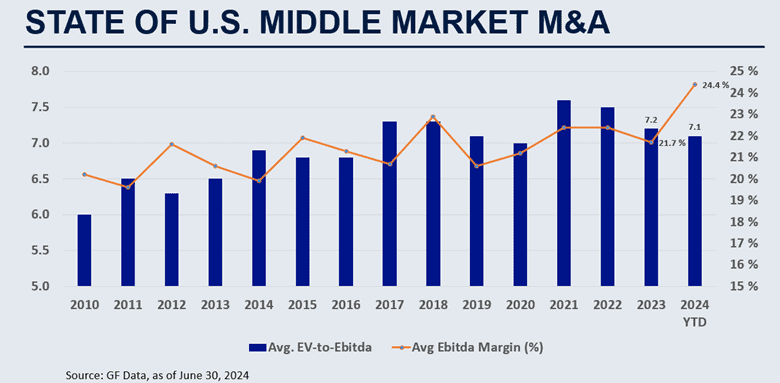

The middle market, defined by deals involving companies with enterprise values between $10 million and $500 million, has largely mirrored broader market trends. Through the first nine months of 2024, total transaction value in the U.S. middle market has hit $11 billion, with a deal count of 181. This positions the market for another down year from the peak in 2021, as business owners and investors digest large investments made in the post-pandemic period, grapple with multiple uncertainties and await lower interest rates.

The average EBITDA multiple for middle market deals has hovered around 7.2x, a relatively stable figure compared to previous years. Additionally, profitability margins in these deals have risen significantly, averaging over 24%.

Key Themes Driving M&A in 2024

Several overarching themes have defined the M&A environment in 2024, particularly in the middle market:

1. Uncertainty Reigns:

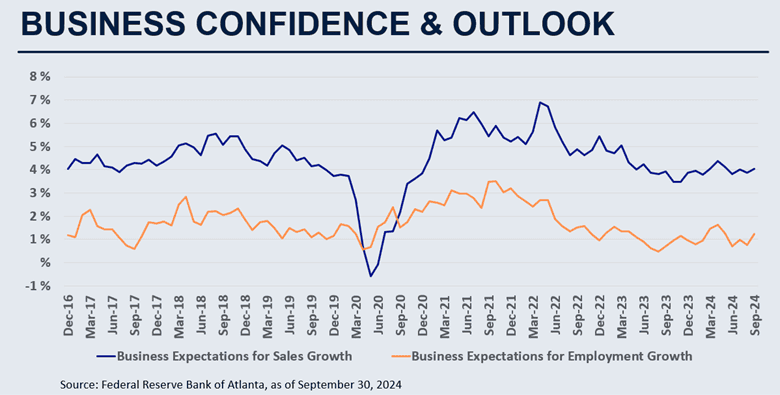

The economic environment remains clouded by uncertainty, with tax reforms and political shifts on the horizon due to the upcoming U.S. elections. Business owners and investors alike are proceeding with caution, particularly in sectors exposed to regulatory risks.

The caution being experienced by business owners can be seen in their expectations for future sales and employment growth. According to the Federal Reserve Bank of Atlanta, business owners expect their sales and employment to grow at a much more conservative rate than they had in the 2021-22 period, reflecting this cautious stance.

2. Flight to Quality:

As uncertainty persists, the focus has shifted from deal quantity to quality. Investors are targeting companies with strong fundamentals, such as higher profitability and resilient business models. This shift is evident in the relatively stable EBITDA multiples and the flight towards more profitable deals.

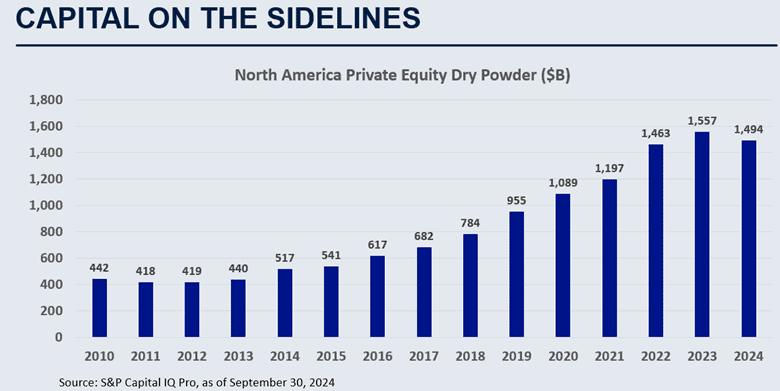

3. Private Equity on the Sidelines:

Private equity (PE) firms continue to hold significant “dry powder,” or uninvested capital, with more than $1.4 trillion sitting idle in 2024. While the number of PE exits is gradually increasing, overall deal activity remains sluggish, largely due to the high cost of capital and the uncertain economic and political environment. However, this could signal a potential future resurgence in M&A as PE firms seek opportunities to deploy capital.

Outlook for the Remainder of 2024 and Beyond

Looking ahead, the M&A market is poised for a cautious recovery. While deal activity may remain subdued in the near term, the abundance of capital on the sidelines and improving economic conditions could drive a rebound in 2025. Key sectors like technology, healthcare, and industrials are expected to continue leading M&A activity, especially as companies look to consolidate and capture market share in an uncertain environment.

For business owners and investors navigating the current landscape, the message is clear: while uncertainty remains, opportunities exist for those willing to invest in quality assets and take a long-term view.

About Blue River

Blue River Financial Group is a middle market merger and acquisition advisory firm. We assist corporations, private equity groups and individuals in the sale and acquisition of businesses and have completed assignments in multiple business segments. With over 20 years of experience spanning across 50 global industries, Blue River provides a suite of services to middle market clients including corporate development, private equity support, valuations, and transaction consulting, placing a premium on relationship-centered transaction counsel and client focus.

Contact Us

Detroit

1668 S. Telegraph Rd., Suite 250

Bloomfield Hills, MI 48302

248 – 309 – 3730

Pittsburgh

1525 Park Manor Blvd., Suite 250

Pittsburgh, PA 15205

412 – 916 – 5016

Colorado

11483 Canterberry Lane

Parker, CO 80138

248 – 309 – 3730